Development

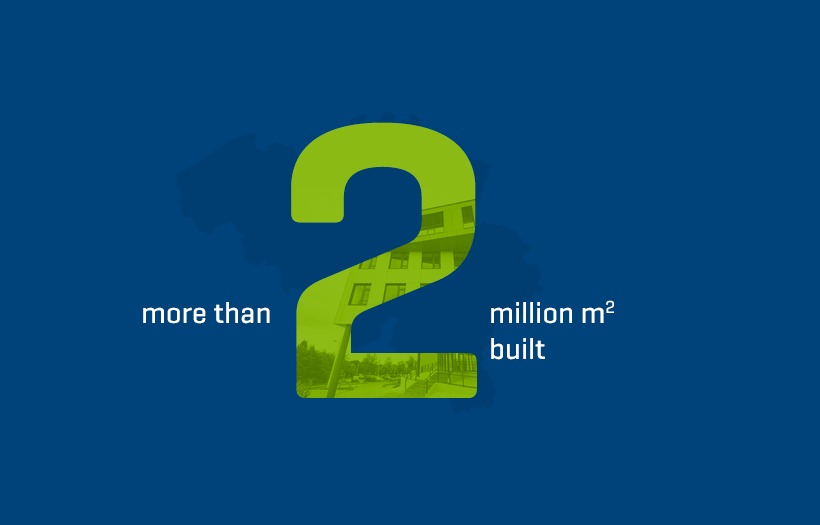

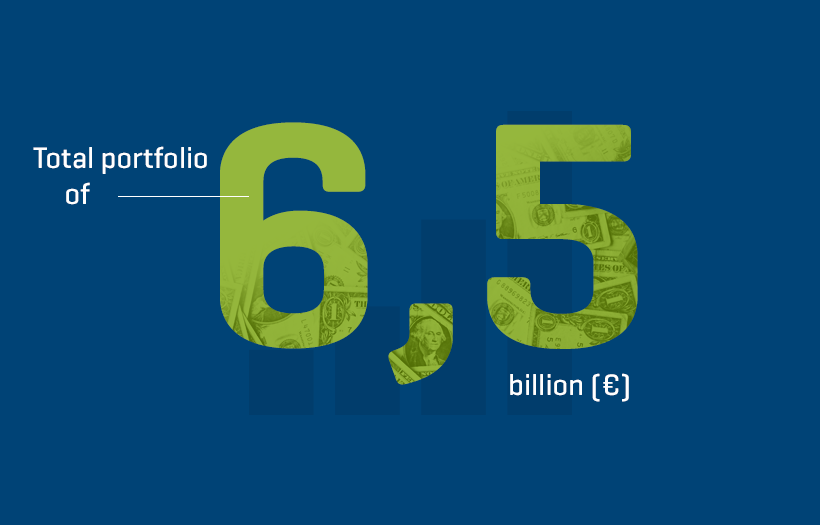

We draw on our long experience in property development to offer our clients and partners advice and guidance to meet their expectations as closely as possible. Our key winning assets: Solid know-how and comprehensive expertise to manage all phases of a project, from canvassing to construction, via design and obtaining permits. Finally, we spare no effort to meet the most demanding sustainability criteria for every urban complex we develop.

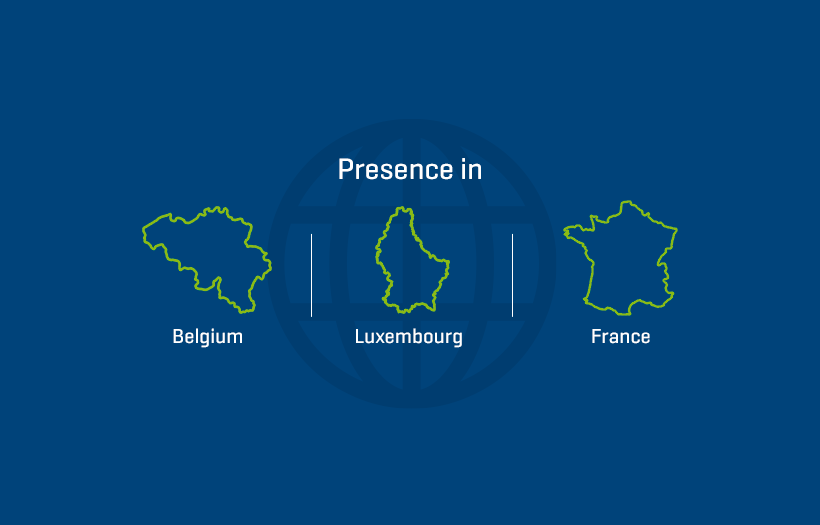

In performing our activities, we give priority to listening and foster dialogue while bolstering synergies with other stakeholders on the market: developers, public authorities, future occupants and buyers. We endeavour to adapt to the demand for flexibility from our clients and potential users during the development phases. We are committed to providing them with modular spaces and maximum flexibility to attend to the new needs that emerge from changes in the ways of living and working – all in compliance with high environmental standards and quality requirements.